'Dementia has overtaken heart disease as the #1 cause of death: What can you do about it?

And in the weekend papers - 'What will retirement look like in 15 years’ time? (hint: quite different) Here’s a sneak peek'

In this edition

Feature: Dementia has overtaken heart disease as the #1 cause of death

From Bec’s Desk: The week ahead is going to be HUGE!

SMH/TheAge: What will retirement look like in 15 years’ time? Here’s a sneak peek

Prime Time: Taking a “grown up gap year” with Monique van Tulder

Ad - Before we start — a big thanks to our newsletter sponsor this week, Viking

Spring Sale Ends Soon: Fly Free & Save with Viking in 2026-2028*

Viking’s Spring Sale is ending soon – don’t miss your chance to explore the world in award-winning style. From Europe’s romantic rivers to the Mediterranean Sea, and from Egypt’s timeless wonders to Asia’s vibrant cultures, our itineraries are designed for immersive experiences. Wherever you choose to go, our state-of-the-art ships, with no kids and no casinos, offer a refined destination-focused experience.

Book a river voyage and fly free or book an ocean or expedition voyage and your companion flies free. Be quick, sale ends 1 December 2025*. Discover the World, the Viking Way.

Dementia has overtaken heart disease as the #1 cause of death

And leading scientists say there’s some things you can do.

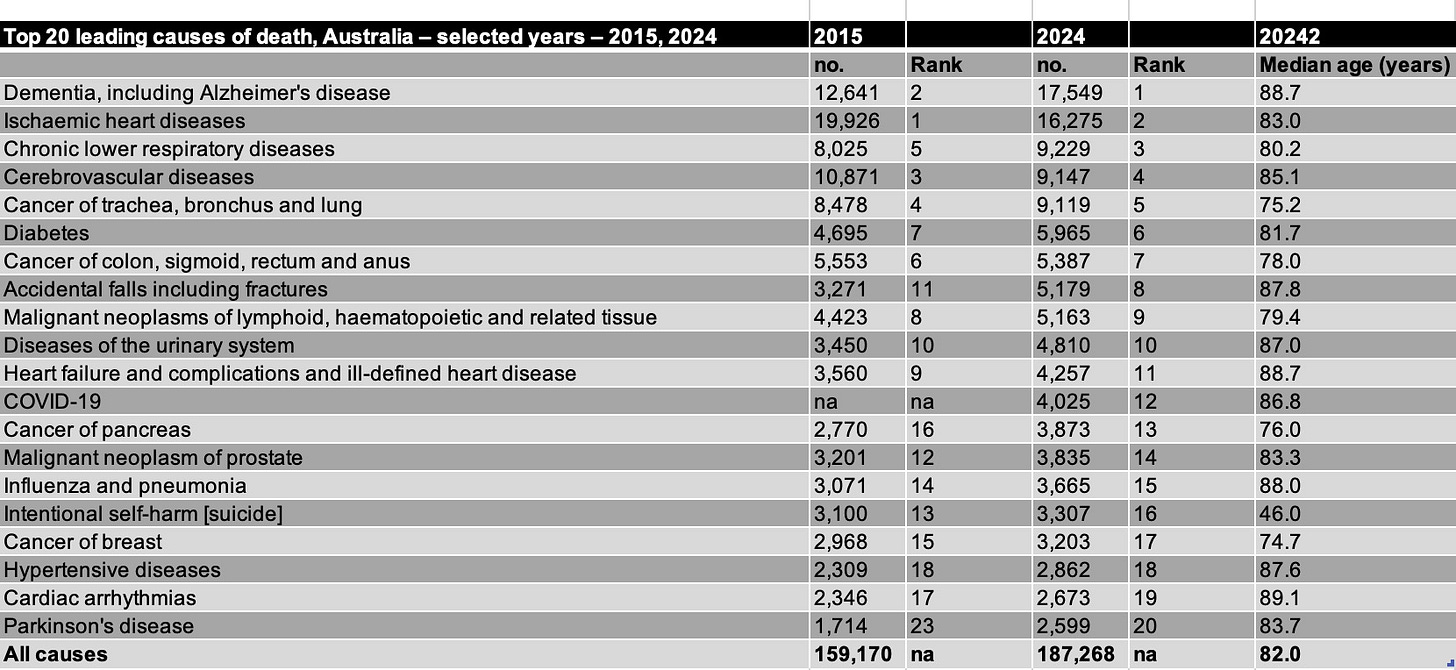

I went through the new causes-of-death data this week (classic midlife-passionate author hobby, I know), and the big takeaway isn’t actually about death at all. It’s about what we can still do – right now – to age better than any generation before us.

The big headline was that ‘dementia has overtaken heart disease as the number one cause of death in Australia’. A decade ago, that would have stunned me. Now it just confirms what we’re already feeling: we’re living longer, and longevity changes the whole picture of what we die of.

But here’s the important part of the lesson: dementia doesn’t start in your eighties. The groundwork happens decades earlier. And according to the Lancet commission, about 40 per cent of the total risk for dementia is down to 12 things we can influence and the ones relevant to midlife include:

moving your body,

lifting weights,

staying socially connected,

protecting your sleep,

learning new things,

focussing on gut health

managing blood pressure, and

sorting out your hearing (one of the most overlooked factors).

And two things here rarely get enough attention in those approaching retirement: your gut and your hearing.

Your gut is basically the command centre of inflammation. When it’s not happy, nothing is happy — not your brain, not your energy, not your mood. A healthy gut helps keep inflammation down, and chronic inflammation is linked to everything from dementia to heart disease to depression. So all those small things — more whole foods, more fibre, less ultra-processed stuff, more pre-biotics and probiotics – all these matter far more than people realise.

And hearing? Honestly, it might be the most ignored brain-health issue of all. Hearing loss is a huge risk factor for dementia, partly because your brain works overtime trying to fill in the gaps, and partly because people withdraw socially when they can’t hear well. If you’ve been “meaning to get it checked,” take this as your sign.

Heart disease is still high on the list, but the trend is heading in the right direction. Prevention – monitoring your blood pressure and cholesterol – is working. Which is reassuring, because it means the small, boring habits we talk about actually do move the dial.

What did surprise me was the surge in deaths from accidental falls — up more than 50 per cent in a decade. The median age is 87.8, which tells the real story: it’s not the fall that kills someone, it’s the weakness, the frailty, the broken bone, the pneumonia that follows.

This is why strength training and balance work are a critical conversation. These aren’t fitness fads – they are the difference between independence and fragility in your 80s and 90s. Your future self doesn’t care about toned arms or rippling abs. They care whether you can stand up easily and move safely without fear.

Respiratory diseases inching up the list also hint that lung fitness matters far more than we give it credit for — and that staying active, keeping the house ventilated, and avoiding smoking still pay off.

So what do we do with all this?

We take it as a reminder that the decades we’re living right now, our 50s, 60s and 70s, are where prevention is important and actually works. Not in a perfectionist way, but in a simple, everyday way.

A bit more movement. Lifting a few heavy things each week, prioritising decent sleep, eating real food that shows care for your gut, and making time to talk to people. Increasibly we need to focus on our curiosity, work harder to create safer homes for ageing in, wear better shoes and practice balance. And finally, we need to take action if our hearing starts to decline, so our brains don’t have to work twice as hard.

The mortality tables look like numbers, but they’re really instructions.

A quiet nudge saying: here’s where the risks are — and here’s what you can do.

And that’s always been the point of Epic Retirement: not fighting ageing… just doing it smarter, and with a whole lot more control than we realise.

This week was a biggie. First was our Epic Retirement Course Live Q&A on Monday evening - the first for the season with Mark Lapedus from Allianz Retire+ - a ripper! Then, Tuesday was the HESTA Live Q&A with Jen Harding for their wonderful exclusive members only course.

After that it was back into the audiobook studio on the UK book which comes out on 11 Dec. Then a lunch and learn presentation to the over-50s team at Suncorp - thanks for the warm welcome guys.

Thenit was off to the Association of Superannuation Funds of Australia Conference in the Gold Coast, to hang out with the industry of super and learn. Such wonderful people in that sector - I always feel their passion, care and honesty. The theme of this conference was Shaping the Future of Super and it was a great event.

Then, off to Victoria to speak at Lifestyle Communities open day in Phillip Island. It’s a bit chilly down here but very beautiful. And finally, back for the absolute last session of the audiobook recordings on Sunday. My voice (and family) will be pleased when that’s over. It’s been a lot of work recording two audiobooks in one month (in the evenings and on weekend mainly) on top of everything else.

The week ahead is gearing up to be HUGE! We’re launching Epic Retirement Month and there’s so much coming. I’ll make you wait until next week to celebrate with us though - because a whole month of learning about how to have an epic retirement truly does lie ahead of us so let’s not jump the gun.

And, my first regular column in The Times in the UK starts! Eeek!

The new Australian and New Zealand book, How to Have an Epic Retirement - the fully revised and improved edition arrives in stores in just 10 days - on November 25th. If you want to pre-order, you can do it now. It’s important for us authors to get pre-orders - and I greatly appreciate your interest. It makes the industry of book retailing see that we’re here. So, if you’re planning on buying one - get in now.

Lastly, I’ve stepped up my game on social media. I’m now making short educational lessons almost daily. It’s fun and they’re getting better and better. Come and follow me on Facebook or Instagram for more. And email me if you have ideas you want me to touch on.

Facebook: facebook.com/becwilsonepic

Insta: instagram.com/epicretirement

Have a lovely Sunday!

Author, podcast host, columnist, retirement educator, and guest speaker

Extract of of my weekly column in The Age, The Sydney Morning Herald, Brisbane Times, WA Today.

What will retirement look like in 15 years’ time? Here’s a sneak peek

I’ve spent this week at the Association of Superannuation Funds of Australia conference – the super industry’s big annual exchange of ideas. The theme was Shaping the future of retirement – a fitting focus for an industry that’s finally waking up to its real purpose: not to build a trillion-dollar pile of wealth, but to give every Australian a dignified, comfortable retirement.

The closing session was a classic. Four of the industry’s finest CEOs and directors took to the stage to imagine what super would look like in 2050.

They spoke of the future of having our own personal agents for advice, super funds becoming the banking layer for people once they’re in retirement, the way regulation needs to evolve, so funds can actually help members in the drawdown years, and all the technology shifts and trillion-dollar projections that make super folk light up.

But while the experts love talking about super, I know most of us just want it to quietly do its magic so we can dream about the life we want. And sitting there, listening to all the futurism, I realised I was thinking about what retirement might feel like when I get there.

I turn 50 soon. If I retire at the current average age of 64½, that puts my retirement around 2040. Just 15 years away. So let’s take a leap forward and imagine what retirement could look like then – the kind of retirement that people my age will shape, not inherit.

People finally receive guidance that is accurate, consistent and transparent. Imagine that.

Work looks different for all of us

By 2040, retirement won’t be a cliff you fall off. It’ll be a long, and much smoother, ramp that begins in your 50s and runs right through your 60s. We’ll spend a decade or more downshifting – working fewer hours, changing lanes, mixing paid and unpaid work.

For professionals, that might mean part-time consulting, portfolio careers or sabbaticals to recharge. For those in physical or vocational jobs, it could mean retraining or moving into teaching or mentoring roles that make use of experience rather than muscle.

Read on — this article continues in The Age, The Sydney Morning Herald, Brisbane Times and WA Today. It is free to read - you may have to sign up, but there’s no paywall on my articles.

Taking a “grown up gap year” with Monique van Tulder

Do you ever wish you could run away… just for a bit?

After decades building a successful career and raising a family, Monique made a bold decision to hit pause. She took what she calls a “grown up gap year” — a long break from the daily grind to travel, reflect and reimagine what life could look like next. That journey became the foundation for her new book, A Grown Up’s Gap Year, and in this episode, she joins me to share how she did it, what she learned, and why we all need to make space to breathe.

This is a conversation about burnout, boundaries, reinvention, and rediscovering joy. Whether you’re dreaming of a sabbatical, craving a career reset, or just wondering if there’s more to life than your to-do list — Monique’s story is packed with inspiration and wisdom for your next chapter - and a whole lot of honesty.

Bec, There are two UQ Profs who are experts in hearing loss in ageing. Prof Piers Dawes & Emeritus Prof Louise Hickson. They could not only expand on the link with dementia but also talk about what we should do about it.