Retiring in the next 12 months? Here’s your real-world to-do list

Plus, in today's papers around the country "Our super system is splitting in two. Which side is your fund on?"

In this edition

Feature: Retiring in the next 12 months? Here’s your real-world to-do list

From Bec’s Desk: Week 1 of Epic Retirement Month was Epic!

SMH/TheAge: Our super system is splitting in two. Which side is your fund on?

Prime Time: How much is enough? Building financial confidence for retirement

It’s Epic Retirement Month!

20th November to 20th December is Epic Retirement Month. It’s the month when the largest number of retirees retire in Australia, in the year - according to my insights. And that’s worth supporting. So we’re providing thirty days of inspiration, education and the kind of practical advice that helps you shape the second half of life on your own terms. Visit my new website for more: www.epicretirement.net.

And help us spread the word - by sending this to a friend you know is thinking about retiring!

Retiring in the next 12 months? Here’s your real-world to-do list

If you’re planning to retire sometime in the next year, welcome to the most exciting, slightly chaotic, wonderfully energising chapter of your life. We’re officially in Epic Retirement Month – that magic window from 20 November to 20 December where more Australians retire than any other time of year – and honestly, it makes perfect sense. Work slows down, the sun’s out, the diary finally breathes again, and for a lot of people, there’s a natural moment of: Right. What’s next then?

So, if you’re looking down the barrel of retirement in the next 12 months, here’s your no-nonsense, totally doable, genuinely helpful to-do list, not the fluffy stuff, the real stuff that sets you up beautifully for an Epic Retirement. Check it off before R-Day!

Start with the life plan, not the money plan

Before you jump into the spreadsheets, ask yourself the big question: What do I actually want this next stage to feel like?

Having an Epic Retirement isn’t actually about stopping work. It’s about shaping the second half (or last third) of life on your own terms.

Think about:

How you want your weeks to look

The travel you want to do in your active years

Who and what you want to invest your energy in

How you’ll stay connected, fit, and purposeful

Whether you still want to work… a bit… or not at all

This “life plan first” approach makes every financial decision 100x clearer.

Sort out your cashflow — your new best mate

Once you stop working, your income flips from earned to layered. And it needs to run smoothly so your retirement feels steady, not stressful.

In the next 12 months:

Map out and properly understand your annual spending, including the good stuff like holidays and hobbies

Understand if and when you’ll be eligible for the Age Pension. Make sure your application is read 13 weeks before so you don’t miss a dollar of it - because they don’t backpay.

Decide how you want to draw income from super, and whether you want a straight drawdown (known as an account based pension), and whether you’ll use a bucket strategy, or guardrails, or a specific product provided by your superfund or adviser to help you manage your drawdowns.

Run the numbers on whether you need part-time income in the early years or not

Understanding your cashflow is crucial – so learn about how it works, then get it humming.

Check your super settings while you’re still earning

This is your Prime Time and you’re possibly either lifestyling or part-timing in the year ahead. To establish how flexible you CAN be, understand your super better. Consider your:

Investment options: Are you appropriately invested (assess your risk tolerance)

Fees: Is your fund or adviser charging fair fees for the service they offer you?

Insurance: Are you coming to the end of needing it?

How close you are to the conditions of release: Know when you can press ‘go’ on tax-free income stream if you want one

Any last-minute contributions you can make to build your balance (yes, making a salary sacrifice counts)

Once you start an account-based pension, the settings matter even more, so set things up now while you’ve still got pay coming in.

Run a tax check – It’s OK not to give the ATO more than they need

Retirement changes your tax position dramatically. And it’s smart to use that opportunity! Think about:

When to trigger the tax-free status of your superannuation income stream

Whether to draw from super or outside super first

Topping up your spouse’s super if they’re behind

Capital gains if you’re selling investments before retirement - delaying until in retirement might put you in a lower tax bracket when you sell; or if you’re selling an asset inside super, triggering retirement might make it tax free.

A tiny bit of planning here saves thousands later.

Decide what to do with your work perks

Got long service leave? Annual leave? Bonuses? Work out:

Whether you should take some leave at full pay while phasing down (a gentle glide path is Mwha (chefs kiss) for your Prime Time runway into retirement)

Whether cashing out leave will push you into a higher tax bracket

If part-timing is actually the smarter move than putting in your final Big Year

Whether you can take long service leave before you retire - and stay insured, keep getting super and annual leave while you enjoy and practice retirement.

Sometimes the best last year of work is actually 0.6 or 0.8 FTE - seriously.

Give your home some thought (but don’t rush a decision)

Your home becomes a financial tool in retirement – not just a memory box or a legacy your kids will sell one day.

In the next 12 months, explore:

Whether you want to age in place

If you’ll consider downsizing later on: and whether you can use this to build your balance by up to $300,000 per person tax free (one off)

Whether you need to fix maintenance issues now so they don’t become $$$ at 70

If your mortgage needs dealing with before your paycheques stop

Your home is your base for the next 20–30 years of life - so think about where you want to age in place, and make sensible lifestyle and financial decisions. Treat it like the big asset it is.

Get your health foundations locked in

You can’t have an Epic Retirement without your health. So use this year to tick off:

Full bloods

Preventive screening

A strength program (maintaining muscle mass = independence)

Find a GP you actually like

Build a plan for fitness that fits your new lifestyle

The biggest retirement disaster isn’t having no money - it’s having crappy health! Truly!

Give your “future self” a break: do the admin

Boring, yes. Critical, also yes. Over the next year, make sure you’ve sorted:

Wills

Super binding nominations

Enduring power of attorney

Password management

A simple document that says who to call about what

Your future self will want to give you a high five for this.

And finally… celebrate the countdown

Remember - retirement isn’t a cliff or a finish line, It’s a transition into a new phase of life. And it should feel like a reward. You can make it a shift into a stage of life with more choice, more spaciousness, more health, more connection, and more of the things that matter if you prepare for it and take it slow.

If you’re retiring in the next 12 months, take a breath. You’re entering one of the most powerful phases of your life. Do the planning, set yourself up well, and then step into Epic Retirement with confidence.

And if you want help thinking it through, download my Epic Retirement Starter Kit here. It’s free, and there’s separate guides for Aussies, New Zealanders and Brits!

Pop over to: epicretirement.net and download it free.

You’ve got this! Make it epic!

And if you know someone retiring who needs a little help - forward this on to them.

Have you visited the Epic Retirement Shop?

Epic Retirement Varsity-Style T-shirts & Mugs

Retiring can very much feel like a milestone event, a bit like school seniors feel when they’re graduating from school. There’s loads of build up,

So, we’ve curated a range of fun varsity-style t-shirts and mugs you can buy for yourself or gift to someone. They’re print on demand - so once you place your order they’ll take 6-10 days to arrive. If you want them for Christmas or the retirement season prior to, you’ll want to get your order in now.

Week one of Epic Retirement Month is behind us and it’s been HUGE! This is a week for helping people learn to have an Epic Retirement. In all of our forums - articles, podcasts, newsletters I’m going back to basics and helping people understand where to start planning for their retirement to make it epic. I’ve had wonderful support - and I have to be very grateful for that. Some highlights include:

We launched our free 16 page Epic Retirement Starter Kit and it’s been a big hit! Download it here - it’s 16 pages of free support.

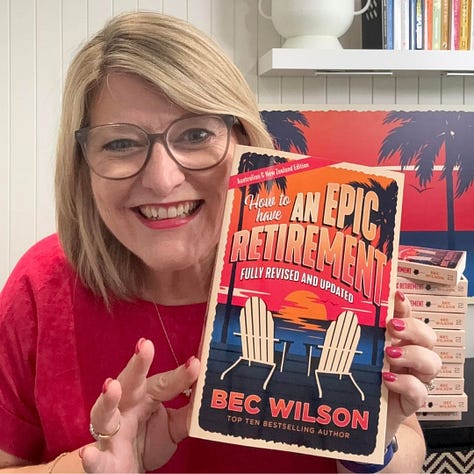

The new updated and improved edition of How to Have an Epic Retirement launched in stores. Lookout for the new cover that says ‘Fully Revised and Improved’.

I presented at Aware Super’s Education Night in Sydney for Couples alongside their Head of Advice, Peter Hogg. Terrific fun!

I recorded a podcast with Maurizio Lombardo, the Head of Advice for Hostplus for Epic Retirement Month (It’ll come out in weeks ahead) - big thanks to Hostplus for sponsoring the Prime Time podcast for the whole of Epic Retirement Month!

We finished the first ever 6 week HESTA Exclusive Epic Retirement Course helping nearly 1000 HESTA Members learn together - and confirmed the next program will kick off in February (so if you’re a HESTA member - watch out for its release).

I did an exclusive interview with ASIC Commissioner Simone Constant about ASIC and APRA’s release of the Pulse Check on Superannuation Funds - and released my article on it in the Sydney Morning Herald (below)

We released a terrific podcast with Peita Diamantidis from Caboodle Financial Advice on ‘How much is Enough’ - one of our big themes for Epic Retirement Month.

An extract of How to Have an Epic Retirement: the updated and improved Australian and New Zealand edition was printed in The Sydney Morning Herald and The Age midweek.

I went on Today Extra to celebrate Epic Retirement Month and launch the new edition of How to Have an Epic Retirement.

My first column was published in The Times in the UK - I’m now their retirement columnist.

I did radio shows on 4BC, ABC North Queensland Drive, ABC Southern Queensland Drive, ABC NSW Regional Drive, and 2BS.

And I received my first print copies of the UK edition of How to Have an Epic Retirement - and I’m so pleased with it.

Week 1 of Epic Retirement Month

Whew! I promised a month packed with education! And now, I’m taking Sunday off – a proper, guilt-free, feet-up, sunshine-on-the-face kind of day. And honestly, I hope you get one of those too.

I really appreciate you being part of this community. You’re here because you’re helping yourself to have an epic retirement, and you’re also spreading the word. That matters more than you know. The buzz, the conversations, the ‘oh wow, I didn’t know that’, the sharing… all of it helps people WANT to learn.

And wanting to learn is half the magic. Retirement isn’t a passive chapter. It’s not something that just happens to you. It’s a self-powered time of life, which means leaning in, staying curious, and building the second half on your own terms.

So thank you. For showing up. For learning. For being part of the shift. And for helping others see what’s possible.

Enjoy your weekend — I’ll be back on Monday with more Epic goodness.

Author, podcast host, columnist, retirement educator, and guest speaker

Australia loves to call our super system “world-class”. But if you’re in your late 50s or early 60s trying to turn your super into an actual retirement, the reality is very different. It doesn’t always feel world-class. It feels confusing, piecemeal, inconsistent, and unless you’re with one of the good ones, your fund can feel like it’s still operating in 2014.

APRA’s latest Pulse Check on the Retirement Income Covenant was handed down this week – essentially, the superannuation sector’s retirement report card from the regulator – and it confirms what many Australians already sense: the industry is splitting in two.

Read on — this article continues in The Age, The Sydney Morning Herald, Brisbane Times and WA Today. It is free to read - you may have to sign up, but there’s no paywall on my articles.

How much is enough? Building financial confidence for retirement

“How much is enough?”

It’s probably the most common question I hear from people approaching retirement. And it’s easy to understand why — we’re all trying to figure out how much we’ll need, how long it needs to last, and how to know we’re going to be okay.

The idea of spending your retirement savings, after decades of squirrelling it away, can feel like a foreign concept. Most people find there’s a fear to spending that they have to overcome.

And so this week on Prime Time and as part of Epic Retirement Month, I’m joined by the brilliant Peita Diamantidis, financial adviser, podcaster, and all-around money explainer, to talk about how to actually feel confident about your retirement money.

Peita shares a clear framework for thinking about spending in retirement, and why confidence doesn’t come from spreadsheets — it comes from knowing how your plan works. We talk about buckets, boundaries, one-off costs, guilt-free spending, and how to shift from “saving at all costs” to actually enjoying the life you’ve earned.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Love this, Bec — the clarity, the practicality, the “life first, money second” framing. It’s such a powerful pivot and one Nigel and I wish we’d understood earlier.

When I stepped out of full-time work in my early 50s, we didn’t think of it as retirement at all — just a one-month trial abroad. But that tiny experiment snowballed into the rhythm we live now: five months abroad, two months home, following the sun, designing our days instead of reacting to them.

And you’re right — the transition isn’t a cliff. It’s a series of decisions that feel small at the time: mapping cashflow, getting clear on what we actually want our weeks to feel like, taking health seriously, and doing some decidedly unsexy admin (I felt that part).

Your whole checklist tracks almost exactly with what we stumbled through on our own — and I know how many people would move into this next phase with more confidence if they had a guide like this.

Epic Retirement Month is such a brilliant idea. You’re helping people make the shift we made, but with fewer missteps and a lot more support.

Thanks for the work you’re doing — it matters more than people realize until they’re in it.

💛 Kelly

Links don’t work 🤔