The retirement mistakes no one warns you about

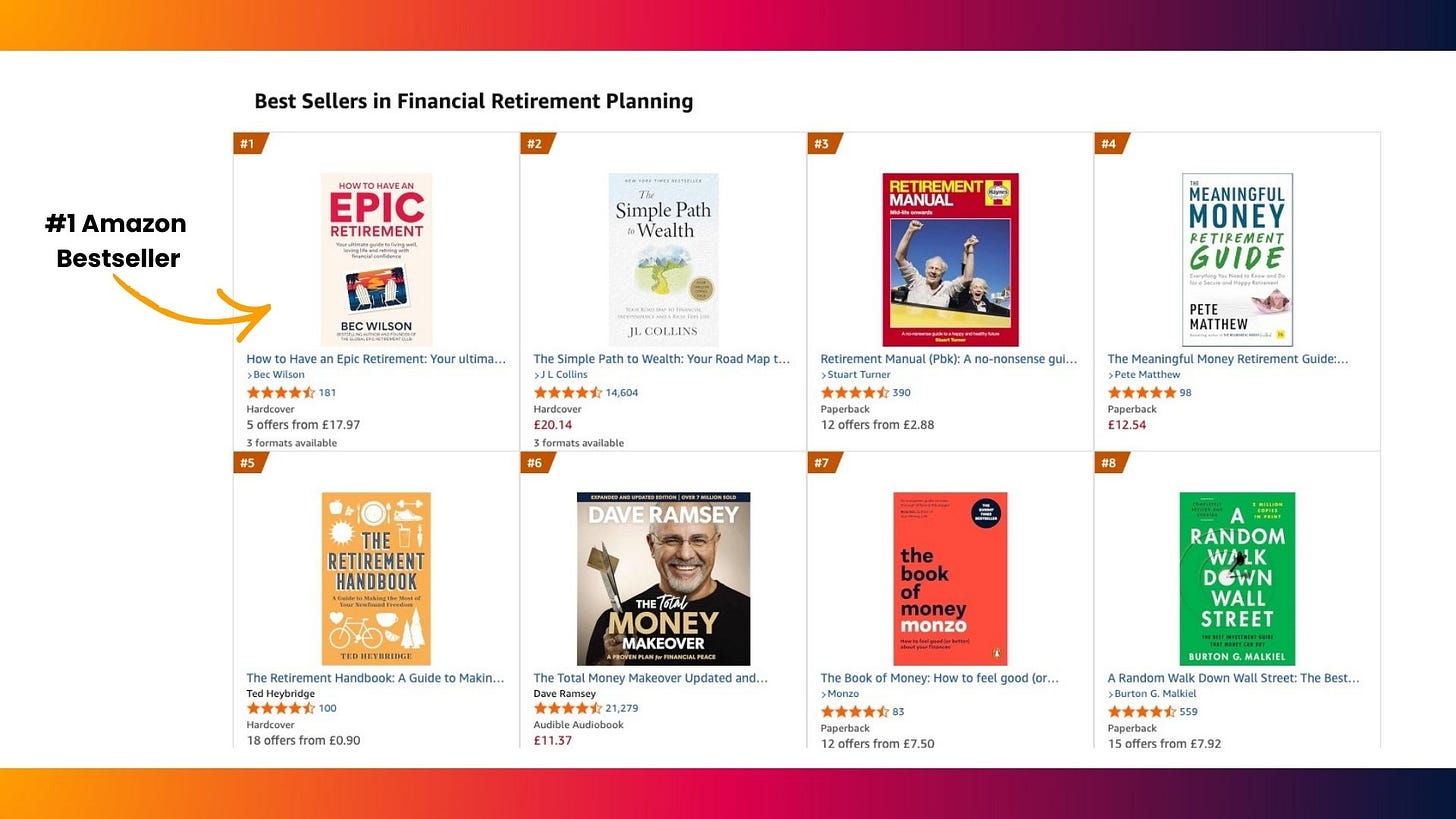

And my UK edition shoots to #1 on the Amazon Financial Retirement Planning bestseller list.

In this edition

Feature: The retirement mistakes no one warns you about

From Bec’s Desk: Week four of Epic Retirement Month

SMH/TheAge: Conversations to have about retirement over the Christmas season

Prime Time: Two shows: The Epic Retirement Tick: What’s changed and Introducing, the new edition of How to Have an Epic Retirement

Ad - Before we start — I want to advertise our next course - which we launched this week.

The Epic Retirement Flagship Course for Feb 2026 is now 25% off. But only for the first 200 places.

The How to Have an Epic Retirement flagship course kicks off on the 19th February. It’s a practical, Australia-first program designed for people in their 50s and 60s who want to understand how to navigate retirement (the easy way). And we all do the program together (we call it a synchronous program).

It covers the stuff that actually matters: how the systems of retirement really work, how to get money into super, then how to turn your super into income, how to think about spending, tax and the age pension, and how to plan for health, purpose and the long game of ageing in place. There’s no jargon. No scare tactics. No sales pitch for products.

If you’re serious about shaping a retirement that feels good to live – not just one that looks fine on paper – this course will show you how.

The retirement mistakes no one warns you about

One of the biggest myths about retirement is that if you get the money right, everything else just falls into place.

It doesn’t. Sorry to be the bearer of that news!

After years of talking to retirees, pre-retirees, and people hovering nervously somewhere in between, I’ve come to realise that the biggest mistakes people make in retirement aren’t usually about super balances, market returns or whether they picked the perfect fund. They’re about their expectations and the timing of their retirement. And they often come from underestimating how much life actually changes when work falls away.

The first mistake I see is treating retirement as a purely financial problem. Yes, saving money, managing cashflow and reducing the tax you pay matters. But retirement isn’t really a spreadsheet exercise. It’s a complete reshaping of your lifestyle. When the plan focuses only on numbers, people are often blindsided by the emotional side. The days are suddenly unstructured. The sense of usefulness can wobble. Social contact drops away faster than expected. None of this shows up in a retirement calculator.

Another common mistake is stopping work too abruptly. Work gives us far more than income. It gives us a real sense of rhythm, identity, purpose and often, a ready-made community. When it disappears overnight, even people who’ve been dreaming of retirement for years can feel unsettled and lost. The retirees who seem to do best tend to taper their work. They work part-time, consult, volunteer, or build a portfolio of activities that eases the transition. Retirement doesn’t have to be all or nothing.

Health is another really big one. Too many people treat their health as something they’ll “get serious about” once they retire and have more time. In reality, retirement is when health becomes the enabler of everything else. Travel, independence, social life, staying in your own home – frankly all of it depends on our physical and cognitive capacity. Strength, balance, mobility and prevention matter far more than people expect, and far earlier than they think.

Relationships also shift in retirement, and this catches many people off guard. Couples suddenly spend far more time together. Some love it while others find it surprisingly hard. Friendship circles often shrink once work drops away, and rebuilding them takes conscious effort. One of the biggest mistakes people make is assuming that connecting with others will just happen. In retirement, it usually needs to be actively done.

Money mistakes still matter too, just not in the way people expect. Some retirees underspend badly, paralysed by the fear of running out, even when their numbers say they’re fine. Others spend freely and quite loosely early on without thinking through how long retirement might actually last. Their super gets treated as set-and-forget, tax isn’t well understood and it’s important, and income strategies aren’t revisited as life changes so people are either struggling unnecessarily, or living beyond their means for longer than they should be. Retirement planning doesn’t end the day you stop working. That’s when it really does begin.

And finally, many people leave the hard conversations about life too late. Ageing, care, housing, support, powers of attorney, wills and estate planning. These aren’t end-of-life issues these are middle of life issues. And they’re quality-of-life issues. Putting them off doesn’t make them go away, it just limits your choices or your family’s choices later.

If there’s one thing I’d love people to take away as they head into the holidays it’s this. Retirement isn’t something you “arrive at” (or run for). It’s something you actively shape over time. The people who do it best stay curious, stay flexible, and keep adjusting as life changes. That’s not a mistake-proof plan. But it’s a far better one.

Week three of Epic Retirement Month is now done and dusted. Just one more week to go. We wrap on the 20th and head off for a break. I hope you are heading off too! It’s been a really busy month. In fact I’m not sure I’ve ever squeezed so much into one month!

This week was monumental!

First, the huge news… My completely rewritten UK edition of How to Have an Epic Retirement had it's publishing day on Thursday, and shot straight to #1 on the Financial Retirement Planning category on Amazon when it hit bookstores. That’s exciting. It’s a huge category, and Amazon in the UK controls ~60% of book sales. It’s been nice seeing it pop up on feeds and in commentary from UK people too. The pensions industry and The Times in the UK have been wonderful.

This week I celebrated Epic Retirement Week with Hostplus on the Podcast - make sure you have a listen to the awesome show with Maurizio Lombardi (below!). He’s one of the leaders in superannuation financial advice, so he’s showing us the way.

And then I presented for hundreds and hundreds of members of Brighter Super at their special epic retirement online panel event.

The new Australia-New Zealand Edition of How to Have an Epic Retirement has now found it’s way out into the world, and it’s selling very well. You can order here.

It’s week 6 of our current cohort, the Summer Edition 25 of the How to Have an Epic Retirement Flagship Course. The last week of the program! We’re talking housing, care and travel this week in our course materials and live Q&A.

And we’ve launched the next 6 week Flagship Course, which kicks off on the 19th Feb and it’s selling like hotcakes. You can learn more or book your place here.

If you haven’t grabbed the Epic Retirement Starter kit yet, this is the LAST WEEK it will be available for free download. The toolkit is designed to give you a simple, practical foundation for everything we’re covering. It’s free, it’s easy to read, and it’s on the website waiting for you.

There’s no Sunday column in The Sydney Morning Herald this week - it’s all finished for the year. Apparently it was read more than 2.2 million times in 2025. That’s pretty cool!

I’ve still got some interesting columns in The Times to come though if you’re a reader.

And don’t forget - I’ve really stepped up my game on Facebook and Instagram. Come along and learn with me.

Facebook: facebook.com/becwilsonepic

Insta: instagram.com/epicretirement

Have a lovely Sunday!

Author, podcast host, columnist, retirement educator, and guest speaker

It’s hard to believe we’ve launched THREE books this year! If you are looking for Christmas ideas, you can order them on Amazon here:

Prime Time https://amzn.to/4hE1kFq

Epic Retirement Australia / New Zealand https://amzn.to/3WNLfDv

Epic Retirement UK: https://amzn.to/4itAu35

Another TWO shows for you this week

First we’re talking goal setting for your epic retirement with Maurizio Lombardi, Executive Manager of Advice Strategy at Hostplus, then, we’re giving you a how-to guide for finding your purpose and your passions with author and modern ageing expert, Marcus Riley. More on this show with Marcus here.

How to set your goals for an epic retirement

If you’re just getting started planning for your epic retirement, or you’re just not sure where to start – you are absolutely not alone.

In this week’s episode of Prime Time, I’m talking about something many of us put off for too long: setting real, meaningful goals for the next chapter of life. It’s not about vision boards or fluffy dreams – it’s about creating real directions for our life. Because if we don’t set goals, we just get what would’ve happened anyway.

I kick off this episode by sharing some thoughts on why goal-setting in midlife matters so much and how to get started, even if you feel stuck.

Then I’m joined by Maurizio Lombardi, Executive Manager of Advice Strategy at Hostplus, to talk about how to turn those personal goals into financial action. He explains how to bridge the gap between your dreams and your dollars, the role the Age Pension may play, and how new digital tools like Hostplus’ SuperSmart platform can help you model your future and feel more confident about what’s possible.

It’s all part of Epic Retirement Month and if you’re ready to start getting clear, this is a great place to begin.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

These mistakes are common. But they don’t have to be.

Many of the shocks she describes are amplified by financial pressure in high-cost cities. Lower your cost base by living in a lower cost of living country with a high quality of life, optimise tax and build income-producing assets, and you reduce the fear that drives poor decisions.

Make those moves earlier and you buy time. Time to build new social circles, stay active and reshape your identity gradually instead of falling off a cliff at 60.

It’s far easier to focus on health, love and fulfilment when restrictive finances aren’t knocking at the door.